#MONEY ORDER FOR FREE#

But you can deposit a money order fee-free into your bank account and usually cash it for free at the issuing institution. Check cashing stores, convenience stores and retailers often charge a fee. Money orders can cost as much as $5 at a retail bank.Ĭashing a money order may cost you, depending on where you take it. USPS charges $1.45 for money orders of up to $500 or $1.95 for orders between $500.01 and $1,000. What Does a Money Order Cost?Įach money order has a nominal fee, which can cost around a dollar at some retailers and check cashing stores. If you purchase a money order from your bank, you’re generally able to pay for the face value of the money order and the fee from your checking or savings account.

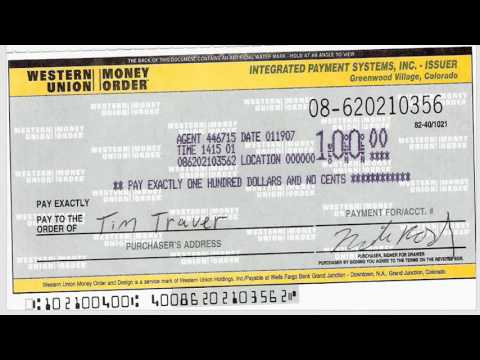

There are a number of institutions that sell money orders. In most cases, you must pay with cash or a debit card, although some providers allow you to buy a money order with a credit card. This means a money order can’t be returned for insufficient funds, unlike a check that can bounce. When you purchase a money order, you must prepay the face value of the order along with the issuer’s fee. It’s important to fill out the money order carefully since you may be unable to correct a mistake. Generally, you can expect to fill in your name in a spot labeled either “purchaser” or “from,” and you will fill in the reason for payment in the “memo” line. Money orders have empty spaces, where you’ll fill out these details: Like paper checks, money orders require that you include specific information. If you buy more than $3,000 worth of money orders in a single day, you’ll be required to complete a special form and produce a government-issued photo ID. For example, at the United States Postal Service (USPS), you can’t purchase a money order for more than $1,000. Just make sure to keep your receipt, so you can track and recover funds if your money order is lost or stolen. Having both pieces of information printed on a money order makes it difficult for anyone other than the payee to cash it. When purchasing a money order, you must provide the payee’s name (the recipient), and the issuing financial institution’s name must be on the order. You purchase a money order with cash or another guaranteed form of payment, such as a traveler’s check or debit card. Unlike a check, money orders can’t bounce. Much like a check, a money order is a paper payment.

0 kommentar(er)

0 kommentar(er)